Singapore is one of the world’s largest trading hubs for liquefied natural gas (LNG). We traded about US$240 billion worth of LNG in 2022, equivalent to about 50 per cent of Singapore’s gross domestic product. This is impressive, considering that Singapore does not produce any LNG. We are also a major trader of other energy products such as oil and natural gas.

Due to our key role in the global energy trade, Gastech 2023, the world’s largest exhibition and conference for the natural gas and LNG industry, will be hosted in Singapore this week. It will gather more than 300 ministers and business leaders, as well as over 40,000 attendees from more than 100 countries.

How did Singapore become a global energy powerhouse and trading hub?

Our strategic location is a key factor. In the 1800s, Singapore was already a key entrepot for commodities such as spices because of its position along the crossroads of major maritime shipping lanes. Traders were further attracted to Singapore when it became a free port in 1819. As trade evolved with changing demand, it became a major trading centre for other commodities like rubber and tin in the 1900s.

The government also had the strategic foresight to develop trade as a key pillar of the economy so that Singapore can be connected to the rest of the world. While we welcome trade in a diverse range of products, there are key areas that we aim to participate actively in. Energy trade is one such area.

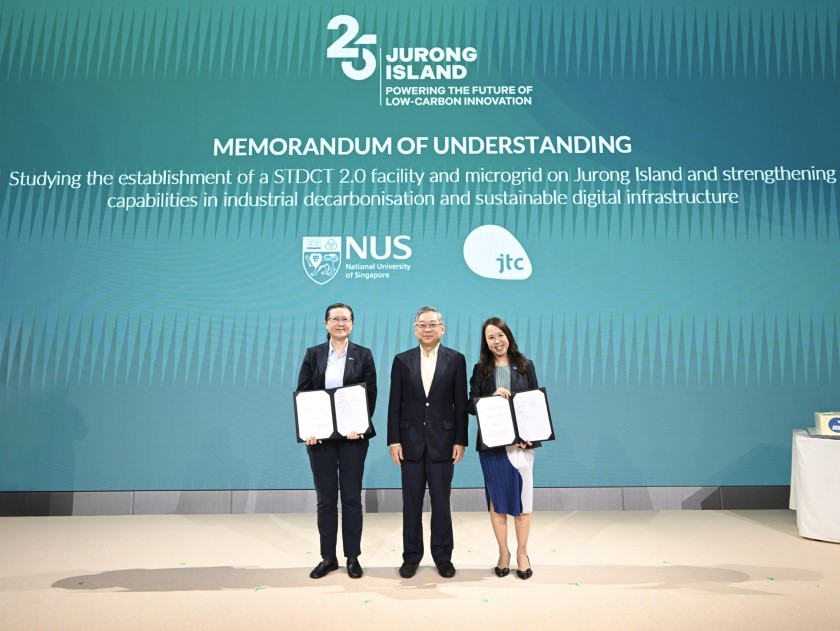

Singapore started off by courting oil majors such as Esso, Mobil Oil and Singapore Refining Company to operate oil refinery facilities here in the 1960s. This allowed the city-state to become one of the world’s top oil-refining centres. The government subsequently developed Jurong Island to meet the need for more industrial land for the growing energy and petrochemical industries. More than 100 energy and petrochemical companies set up their plants there, thanks to its integrated facilities allowing for interlinked production processes – where output from one plant becomes input for another.

Alongside this development, Enterprise Singapore (EnterpriseSG) – then the Trade Development Board – launched the Approved Oil Trader programme in 1989 to attract oil majors and trading firms to conduct international trade from Singapore. The Global Trader Programme was later introduced in 2001 to further grow the pool and diversity of global trading companies. It also encourages companies to choose Singapore as their base of operations to manage their global or regional trades from here.

EnterpriseSG has attracted some 400 global traders to anchor their key business activities in our city-state to buy, sell and market a diverse mix of commodities to other countries around the world. These global traders have created 16,000 jobs in Singapore, of which close to 80 per cent went to locals.

Energy trade forms close to 60 per cent of this total value, largely driven by the trading activities of about 150 major energy players in oil, gas and LNG that have established a presence in Singapore. Such players include Shell, ExxonMobil, Saudi Aramco and PetroChina.

Growing LNG activities and capabilities

As part of the Trade 2030 strategy announced by the Ministry of Trade and Industry in 2022, Singapore will continue to deepen and widen its trade. The ambition is to double offshore trade to US$2 trillion by 2030; growing the energy-trading sector will contribute to this goal.

LNG trade is a major component of Singapore’s total energy trade, with trade volumes here almost doubling between 2018 and 2022. We expect demand for LNG trade and production to continue to grow, given that gas consumption in the Asia-Pacific is expected to double to more than 1,600 billion cubic metres by 2050 from today. This offers an opportunity for Singapore to leverage its position as a global trade and energy hub to support global LNG needs.

To enable this, we will continue to strengthen the presence of companies and their capabilities across the LNG value chain. To date, more than 60 such companies have established LNG operations in Singapore. Among these, firms such as BP, Diamond Gas, ExxonMobil and Jera have anchored their global LNG headquarters here. Their traders manage these companies’ entire global LNG trading activities from Singapore, while facilitating LNG trade from the city-state to other markets including Australia, China, Japan, Korea and the US.

We have also developed manpower initiatives to build our pool of local expertise to support LNG trade. For example, the Leadership Development Initiative for LNG professionals was launched last year for local professionals to acquire new competencies. This will enable them to join the trading desks of LNG companies such as Chevron and TotalEnergies.

Supporting a low-carbon future

Singapore is also taking active steps to develop more sustainable energy sources to support our net-zero ambitions by 2050. These include research and development and innovation initiatives to decarbonise key sectors, and diversifying our trade to include emerging and sustainable products.

For example, we work with companies to develop new solutions to decarbonise the maritime industry. Seatrium delivered the world’s first converted floating liquefaction vessel in 2017, while Strategic Marine launched South-east Asia’s first hybrid crew transfer vessel to support offshore wind operations in March 2023. Additionally, Maersk and Hong Lam Marine conducted the world’s first ship-to-containership methanol bunkering operation in July 2023.

We are also building the ecosystem of carbon services and trading firms to support low-carbon projects and help organisations measure and reduce their emissions. Singapore now has more than 100 of such companies, including carbon exchanges ACX and Climate Impact X. Internationally, we are working with countries such as Colombia, Indonesia, Morocco, Peru, Papua New Guinea and Vietnam to enhance trust and transparency in carbon-credit trading.

Singapore has also developed a national hydrogen strategy to explore the use of advanced hydrogen technologies, accelerate hydrogen deployment and pursue international collaborations to enable hydrogen supply chains. We hope to eventually work with global traders here to develop Singapore into a key international trading hub for hydrogen.

Trade has been, and still is, the lifeblood for Singapore. It creates good jobs, ensures our relevance to economies worldwide, and keeps us at the forefront of global demand and supply of goods. While the specific products that we trade may evolve over time, trade will remain core to the economy.

EnterpriseSG, in partnership with our industry partners, will continue to champion efforts to ensure that Singapore remains at the heart of global trade.

The writer is assistant chief executive officer for trade and connectivity at Enterprise Singapore

This article was published in The Business Times on 4 September 2023, and is republished with the writer’s permission.